Institute For Ethical Hacking Course and Ethical Hacking Training in Pune – India

Extreme Hacking | Sadik Shaikh | Cyber Suraksha Abhiyan

Credits: moneylife

Narendra Modi-led National Democratic Alliance (NDA) government aims to make cash handling expensive and also to reduce to minimum the transaction cost for digital payments. However, even digital payments are likely to cost more if the government decides to impose a ‘security fee’ or cess on each online payment.

According to a media report , the Department of Financial Services (DFS) under the Ministry of Finance, has proposed during a high-level meeting, to impose a token ‘security fee’ on each digital payment in India. This ‘security fee’ or cess like the Swachh Bharat cess, could be used to create better infrastructure for secure digital transactions, the meeting was told.

Prasanto K Roy, Head for Internet Council of NASSCOM, told ThePrint, “A special fund could help develop security infrastructure, hire experts and secure online transactions, though a cess on digital transactions is not the best way of doing it. The Ministry of Finance and the Ministry of Electronics and Information Technology (MeitY) need to encourage digital transactions by making them cheaper, not more expensive. There are other, better ways to fund digital security.” But imposing cess to create fund that can be wastefully spent with little or no accountability is the favourite strategy of officialdom.

At present, users pay various charges for digital transactions. This includes convenience fee, transaction charges, and cost for plastic card, like annual or joining fee as well as merchant fees. Whenever a debit or credit card is swiped, the merchant pays certain fee to card issuing or acquiring bank and payment network providers like Visa, MasterCard and RuPay. Such charges may prevent a user from doing the digital transaction and instead opt for cash payments.

With the demonetisation drive, the government aimed to curb cash transactions and thus promoted digital transactions in a big way. The government gave several concessions to people, like waiving transactions charges and reducing merchant discount rates (MDR). This continued till March 2017, after which people started to realise real impact of hidden costs of digital transactions. The proposed cess would only add up to the cost for the customer.

In December 2016, Amitabh Kant, Chief Executive of NITI Aayog, while speaking at the annual meeting of FICCI, had said that the government had ‘long-term plans’ to impose a cess on cash transaction in order to encourage digital transactions.

“Earlier, there was a charge of 1.5-2% on digital transaction when its volume was low. However, its volume has increased now. Since 8th November, it has gone up by 316% for RuPay, 271% for e-wallets, 119% for UPI, 1,202% for USSD and 95% for POS (Point of Sale). Now, volume of digital transaction has increased, so charges on it will be low. The merchant discount rate (MDR) should fall,” he had said.

Interestingly, as per a report from the Economic Times , the government has set a lofty goal of 25 billon digital payments by end of FY2017-18. “With half the year gone, less than a third of the total targeted transactions are via digital modes. Take, for instance, debit cards. It is the ubiquitous cashless option in circulation (about 700 million) and surprisingly among the least in use – other than at ATMs. Low penetration of point of sales (PoS) terminals or card swipe machines and concerns over security make debit cards less attractive. So, if there are 700 million debit cards, there are only 2.5 million PoS machines for these cards, which are concentrated in large metros,” the report says.

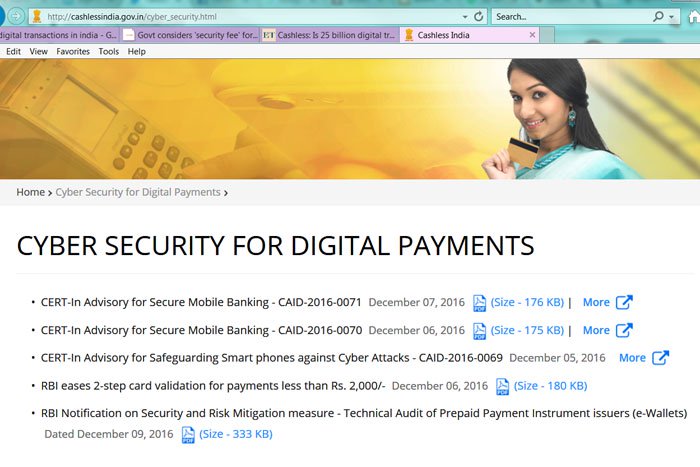

To encourage digital payments, the Modi government launched CashlessIndia.gov.in website, which was expected to help promote less usage of cash. However, the website, managed by MeitY, has nothing more of its own to offer to visitors. In fact, its page for cyber security for digital payments, has five posts, three links to CERT-In Advisory and two for notifications from the Reserve Bank of India (RBI).

The page for promoting digital payments among people at CashlessIndia.gov.in, also contains links to notifications, circulars or news reports. There is nothing on spreading awareness among consumers on digital payment or transactions. But then that is how the government machinery works. They will push you into the water and the moment you manage to float, they will charge you for raising your head above the water! It may be remembered that the speech of Narendra Modi on 8th November 2016 announcing the demonetisation, had no mention of turning India to a cashless society. Cashless as an objective of demonetisation was quickly thought of when it was clear that the bulk of the money would come back to the banks.

www.extremehacking.org

Sadik Shaikh | Cyber Suraksha Abhiyan, Ethical Hacking Training Institute, CEHv9,CHFI,ECSAv9,CAST,ENSA, CCNA, CCNA SECURITY,MCITP,RHCE,CHECKPOINT, ASA FIREWALL,VMWARE,CLOUD,ANDROID,IPHONE,NETWORKING HARDWARE,TRAINING INSTITUTE IN PUNE, Certified Ethical Hacking,Center For Advanced Security Training in India, ceh v9 course in Pune-India, ceh certification in pune-India, ceh v9 training in Pune-India, Ethical Hacking Course in Pune-India